Back in the Saddle Again

So it’s been a while since I’ve posted. I took a couple of month hiatus while the market worked itself out. Back in the Saddle Again.

Feels appropriate. Enjoy

Recently I’ve become pretty active in the market again. And, that’s the beauty of being a speculator. We get to choose our moments. We get to choose when we bet and how much.

So— the market has dragged me back in. Sometimes the opportunities are compelling and that’s what we have seen. I’ve had a couple of big weeks since getting involved again. Nearly every trade I’ve done has been either a buy or a fade-off of the high volume close.

AMC is good example of what I’ve been doing. Earnings move, gapped down, and had a reversal - flagged out bought (a lot) on the range break and then trailed it out selling into spikes.

Of course, the pivots work on the short side too:

Big Picture

The Q’s now look to breakout of a minor consolidation after a bottom in June. There’s a bit of room up to the next consolidation level.

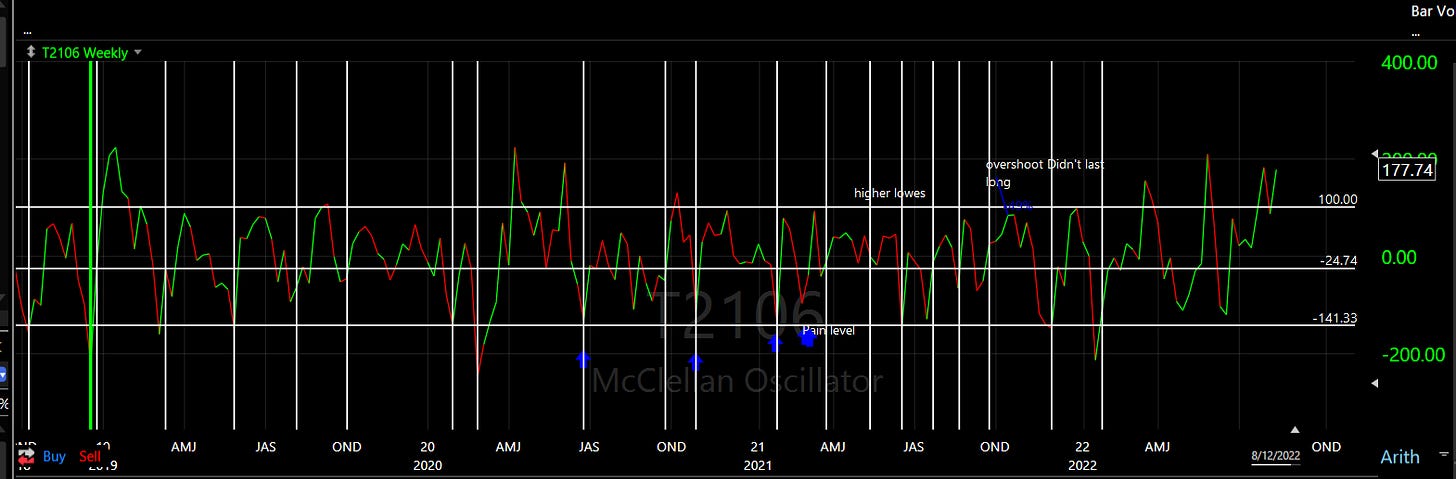

Of course, we always need to monitor our risk level and weigh the risk we are taking. The biggest risk I see right now is that we are pretty forthy on breadth metrics.

177 on the McClellan

80% on the T2108 - the percentage of stocks over the 40ma.

This type of breadth level has often preceded corrections. For that reason, I’m not taking aggressive positions overnight. I’m of the opinion that being nimble is the best approach here.

What I’d like to see is the market attempt a pullback and hold with a higher low and hold the 313 level on the Q’s. But we could just get silly and run to the 200 ma in a couple of days.

Speculators are at their most vulnerable when things are working.

This is no time to lose discipline. It’s no fun getting caught in a gap with too much exposure. Force yourself to follow the process.

Cheers,